New Geo Market Opportunities – Localization is on the Rise

Being in the web technology arena, there are no shortages of new geo market opportunities available based on the current and predicted online usage trends and 3-screen adoption rates across the globe. These geo market revenue opportunities can be assessed, prioritized and correlated against the following technology adoption facets, industries and verticals. Timing of opening up into these markets is imperative to the success of this new product introduction or new market roll out.

This geo market information should assist in the business decision making of what new product and innovative web technology initiative we should implement, and in which geo market to target when it comes to localization and supporting global markets, regions, cultures and locales.

This geo market information becomes even more important when entering into the space of location-based services that bridge desktop-to-mobile devices and the 3 screen access to the Web-based product. 3 screen device convergence is on the rise as software developers, content providers, telecommunication providers, cable operators, media companies and consumer electronic/digital devices all move towards supporting the following consumer interfaces: Desktop (Win and Mac), Mobile Devices (iPhone, BB, WM, Android) and IPTV (Internet TV, Digital TV, etc).

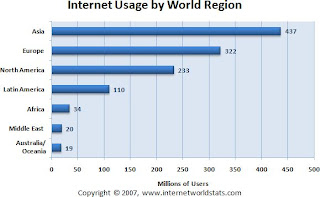

Internet Usage by Region

There are 1.9 Billion Internet users worldwide as of June 2010.

Asia has almost doubled its Internet usage, this exponential growth is significant due to the large population

Asia has seen the most substantial growth (88% increase) as it has almost doubled it’s usage base from 437 M in 2007 to 825 M users in 2010 . This is increase Asia web activity is also apparent in the Top 20 Alexa Ranking – where at least 5 of the sites are Asia based. The market potential for Asia market is off the charts. To add to this the pornography industry is a $97 Billion industry, with $73.7 Billion (76%) being driven out of Asia.

Europe is constant as Western Europe sustains and Eastern Europe continues to trend up

Europe has seen a 48% increase from 322 M in 2007 to 475 M users in 2010. Internet usage is on a constant upward trend as Western Europe displayed earlier and fast Internet adoption (almost on par with North America) where as Eastern Europe is up and coming now but still not as drastic as Asia.

North America is on a constant upward trend as each household has > 3 computer / connectivity devices

North America was an early adopter of Internet access, more specifically broadband so has seen very little growth of 15% in comparison to Asia. Internet usage in NA steadily increases with household populations, as it is typical for the average household to have > 3 Computers / Connectivity Devices (Mobile) within the home.

Latin America has seen significant increase relative to its smaller population

Latin America / Caribbean was a slower market to adopt due to having less general wealth but is on a constant and steady increase as the price of computers continues to decline. It has seen a 85% increase which is significant but still not as drastic as Asia due to the larger population of Asia.

Latin America / Caribbean was a slower market to adopt due to having less general wealth but is on a constant and steady increase as the price of computers continues to decline. It has seen a 85% increase which is significant but still not as drastic as Asia due to the larger population of Asia.Africa has seen a drastic increase but again is relative to its smaller population and access to Internet

Africa has seen a drastic increase from 34 M in 2007 to 111 M users in 2010. Very significant but again is relative to the smaller population pool who can actually afford the technology.

Middle East has seen a drastic increase but again is relative to its smaller population and access to Internet

Middle East has seen a drastic increase from 20 M in 2007 to 63 M users in 2010. Very significant but again is relative to the smaller population pool that actually have access to the technology.

Australia / Oceania has seen very little change

Australia has seen very little change with Internet usage over the past 3 years. However when it comes to the most promiscuous nations, Australia is up there along with the UK.

Broadband and Mobile Adoption Trends

North America

The North American broadband adoption is on a steady increase averaging an additional 4.5 million broadband subscribers per year. The ratio of Cable to DSL broadband adoption is currently 5:3 subscribers. When compared to the European Market, the North American broadband adoption has already attained its momentum and constant growth – where as the European Market is at a slower but much more aggressive pace of broadband penetration. The North American mobile market currently trails behind the European mobile market in terms of mobile phone adoption, and the multi‐purpose functions of a mobile device that exceed just a phone i.e. SMS, email, games, media, entertainment, camera, MP3 player, Internet access, etc.

Europe (EU)

The European broadband market is hot, cut‐throat and an extremely competitive melting pot, especially in the UK where operators have been forced to separate their wholesale and retail units, and where the large network operators do not necessarily have competitive advantage by default. Instead the smaller operators are empowered to undercut the industry giants by leveraging the “free for all” laws that enable them to easily provide DSL broadband services, especially when the territories of Cable operators are not as hard‐lined, rigid and abundant as they are in Canada and the US. France, Austria and Italy operators seem to be leading the way for the adoption of an IPTV offering and truly embracing the triple‐play concept. Whereas in Central and Eastern Europe (i.e. Romania, Poland, Russia, etc), broadband penetration is hitting a stifling 35% penetration so the potential there cannot be overlooked.

Middle East

The Middle East market is the slowest in terms of Internet use and broadband adoption, as the entire Middle East only totals a 2% share of the rest of the world’s online community. This is not a bad thing, this just implies that the pace is slower but the market opportunity for adoption is huge.

Asia

Asia makes up 36% of the global online community with 437 million users, which has seen exponential growth in broadband adoption over the past 3 years. This presents countless market opportunities as this growth peak can definitely be leveraged to further convince operators and subscribers that premium broadband services is a good idea to complement their broadband service and to help them attain that digital lifestyle.

Latin America

The South American market makes up 9% of the global online community with 110 million users. The take‐up and spread of the South American broadband market is very similar to that of Eastern Europe. Once again the potential opportunity cannot be overlooked here due to the slower but up and coming pace of adoption.